Eurasian rail traffic in 2018: heading to a million TEUs

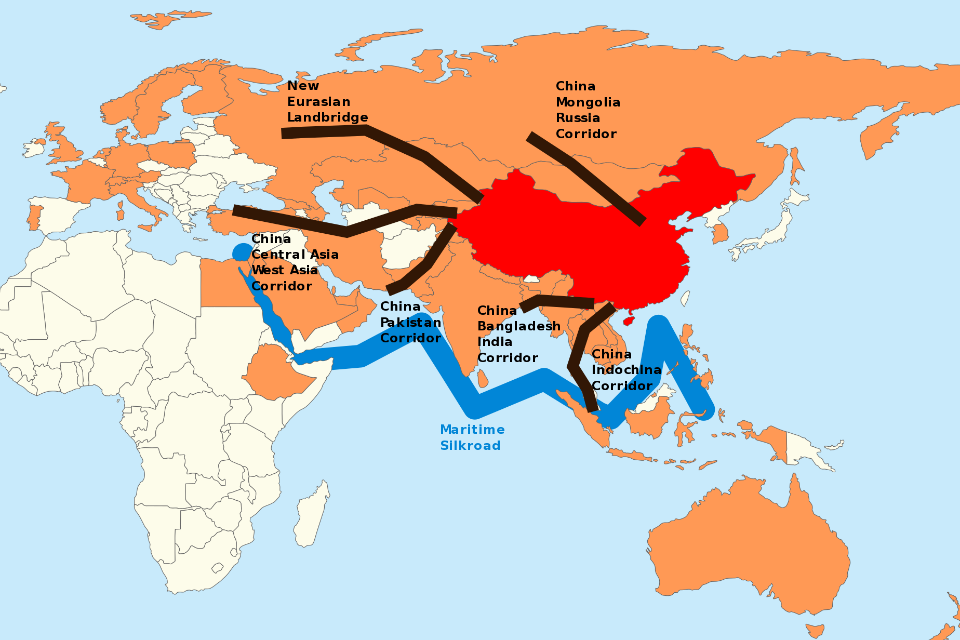

Looking back at railway traffic between Europe and China this year, one could say that 2018 was a successful year. The volumes more than doubled, alternative routes grew in popularity, new multimodal options became operative and many, many new connections were established. The New Silk Road is still on the rise and well on the way to a million TEUs.

Measuring the success in numbers, the questions arises which volumes you count. Most statistics zoom in on the northern route, to which the New Silk Road owns it name. The total volume of freight traffic transiting via the broad gauge network of Russia, Belarus and Kazakhstan amounted to 245 thousand TEUs in the first eleven months of 2018. This indicates a growth of 58 per cent in comparison to the similar period last year, when this value was 155 thousand TEUs, according to the United Transport and Logistics Company – Eurasian Rail Alliance (UTLC ERA).

These figures indicate a continuing trend where volumes nearly or more than double each year. In 2015 traffic on this route amounted to 46,000 TEUs, while it grew to 104,500 TEUs in 2016. In 2017, the total volume was 175,000 TEUs. If this trend continues, volumes should hit a million TEUs in 2020, an ambition pursued by UTLC ERA. According to multimodal transporter KTZ-Express, the route should be able to handle as much as 1.7 million TEUs that year. However, this is also the year when Chinese subsidies may be discontinued, which is likely to have a significant effect on the numbers.

Other routes

Although the northern route is the most popular, volumes are also increasing on other routes between Europe and China. The volume of containerised freight shipments along the Trans-Siberian railway through Russia grew by 22 per cent in the first eight months of 2018. Between January and August 2018, 590 thousand containers were shipped on the Trans-Siberian connection. This is already more than the total volumes in 2017, which counted 262 thousand containers, according to Oleg Belozerov, CEO and Chairman of the Board of Russian Railways.

Meanwhile, volumes on the Middle Corridor are gradually on the rise. This lesser known multimodal route transfers cargo from China through Azerbaijan and Georgia to Turkey, from where it enters Europe. According to joint organisation the Middle Corridor, traffic along this corridor amounted to 15 thousand TEUs this year, a massive rise considering the 200 TEUs in 2017.

Change of routes

2018 was marked by a number of geographic shifts in the railway routes between Europe and China. The traditional route though Poland and Belarus via the border crossing of Malaszewicze-Brest is congested, and although border operator PKP Cargo has stated to have plenty of spare capacity, many journeys were diverted to other Polish-Belarussian borders. UTLC ERA launched its regular container service crossing Svislach in March, and it has operated a container service via Bruzhi since August 2017.

Meanwhile, the route via Kaliningrad increased in popularity. Opened in the last quarter of 2017, it gained the interest of many operators trying to find alternative routes on the New Silk Road. It offers a transit over land via Lithuania, but also transshipment at the port of Kaliningrad. In September, the overall container traffic of the multimodal route amounted to 3 thousand TEUs, and it is expected to reach 4 thousand TEUs by the year’s end. Volumes are likely to increase even further with the launch of the regular multimodal route Rotterdam-Chengdu via Kaliningrad in November this year.

East-European gateway

Austria, Hungary and Slovakia became increasingly important on the New Silk Road this year. In April, Rail Cargo Group (RCG) launched a regular service Vienna-Chengdu via Slovakia and Ukraine. It was the fourth connection by the ÖBB-subsidiary, which already ran weekly services between Changsha and Budapest and Chongqing and Duisburg. Austria has the ambition to develop the eastern-European gateway further. Within this context, Austria and Slovakia are currently planning for the extension of the broad gauge line from Košice to the greater Vienna area.

Thanks to developments as these, Ukraine is similarly growing in importance as a transit country, whereby the busy border crossings of Poland can be avoided all together. Not only traffic via Slovakia and Hungary enters Ukraine; trains from Poland have increasingly used the Polish-Ukraine border of Slawkow to divert south, towards Georgia and further along the Middle Corridor. A good example was the commitment of PKP LHS to launch a regular Chengdu-Slavkov service, similar to that of the Far East Land Bridge (FELB) to launch a Sławkow-Urumqi line.

Middle Corridor

Many new routes were launched along the Middle Corridor. A regular route linking the eastern Chinese city of Lianyungang with Istanbul was launched this month, while the Dutch city of Venlo was connected to China via Istanbul a month earlier. Turkey and China are not the only destinations on this route; the Middle Corridor also serves as a route into Iran. Although rail traffic to Iran has slowed down due to the US sanctions on the country, Hupac successfully tested a connection Slavkov-Bandar Abbas in May.

Meanwhile, new connections developed between Iran and China, such as the connection of Bayannur city in north China’s Inner Mongolia Autonomous Region to Tehran, launched in May. In September, a new freight train service linked Inner Mongolia Autonomous Region with the Iranian city of Bam.

An EU project

Although the New Silk Road is often called a Chinese project, Europe cannot deny that it is affecting its rail freight business. More and more European hubs are linked to China via the many routes to China and 2018 was no exception: Amsterdam, Mannheim, Barcelona and Riga are just a few examples.

The EU does not participate in it, but it is also not a simple spectator of it”, explained by Maja Bakran Marcich, Deputy Director-General of the Directorate-General for Mobility and Transport (DG MOVE) at the European Commission in September. Two months later, it presented the TEN-T maps of Armenia, Azerbaijan, Belarus, Georgia, Moldova and Ukraine. “The EU’s Trans-European Transport Networks (TEN-T) are being extended to countries bordering Asia. The EU should now connect the TEN-T with networks in Asia”, the EU Commission commented.

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer