Everyone wants to reap the fruits of INSTC

What started as a far-fetched but relatively promising route and developed into Russia’s main diversification corridor is now becoming a hot trend everyone wishes to join. It’s all about the International North-South Transport Corridor (INSTC) in which Belarus wants to be more actively involved, according to its prime minister Roman Golovchenko.

Glovchenko shared some interesting views during a meeting of the intergovernmental council of the Eurasian Economic Union (EAEU) held a few days ago. In his words, “all EAEU member states should be actively involved in the INSTC project” in the context of “rearranging logistics corridors”.

In simple words, Belarus also wants to join the Russian endeavour to exploit Central Asia and surrounding markets, including India and the United Arab Emirates. Far from surprising, this viewpoint indicates that Belarus also feels the heat of sanctions on its trade and economic relations. In addition, it signals that Russia’s approach to the INSTC could be more structured and well-organised than expected and poses a question about Europe’s role in this situation.

‘No infrastructure’

Is it worth it joining the INSTC, though? One could say that any diversification attempt can prove worthy when sanctions hit. Especially in the INSTC’s case, with new markets opening up and Russia already exploiting part of its potential, it seems like a well-paved route that Belarus could also follow.

Nevertheless, Glovchengo showed some self-restraint despite his explicit request for a stronger Belarusian presence across the INSTC. “Development prospects of our economies depend on whether logistics is functioning well and whether it is adapted to new geopolitical realities”, he said, according to the Belarusian news agency BELTA.

In particular, when enumerating challenges, he referred to the problematic, fragmented, or missing infrastructure along the INSTC, which currently poses the central developmental issue in the corridor. “We need to address the problem of the missing infrastructure”, he said, underpinning the idea of closer collaboration and investments within the EAEU member states and the BRICS framework since India is gradually becoming critical for the INSTC. “For example”, he continued, “the New Development Bank established within the framework of BRICS” could streamline some developments.

More states onboard

The EAEU and BRICS are two different entities that become all the more relevant for the INSTC. BRICS refers to the world’s fastest emerging economies and includes Brazil, Russia, India, China, and South Africa. The fact that Russia, India, and China are close partners in this organisation highlights the potential involvement of the New Development Bank mentioned by Glovchengo in the INSTC. After all, Russia is a good trade partner for India and China. The only reason that BRICS would not be involved in the INSTC would be China’s hesitation to jeopardise its Belt and Road Initiative by allowing more space for India to grow and become influential in the region.

On the other hand, there is the EAEU, consisting of Armenia, Belarus, Russia, Kyrgyzstan, and Kazakhstan. EAEU states are either already involved or aim to get involved in the INSTC. The Union itself is actively advocating the corridor’s development and plays a role in investing in new projects.

The latest example is the Eurasian Agroexpress rail logistics project that the EAEU aims to expand outside its borders and include Iran, the United Arab Emirates, India, and Turkmenistan. Consequently, it is observed that Russia and its partners are gradually gaining trade control of the Central Asian region and surrounding markets and have plans to enable more investments.

What is Europe doing?

After the Russian invasion of Ukraine and the consecutive sanctions by the West, Central Asia has become a much more relevant region for the European economy. Especially when it comes to natural resources and agricultural products, countries like Kazakhstan and Uzbekistan, for instance, are becoming increasingly important. Companies involved in rail logistics highlight that Central Asia is a new and relatively untapped market that could help the industry and the European economy reduce its dependence on Russia and China.

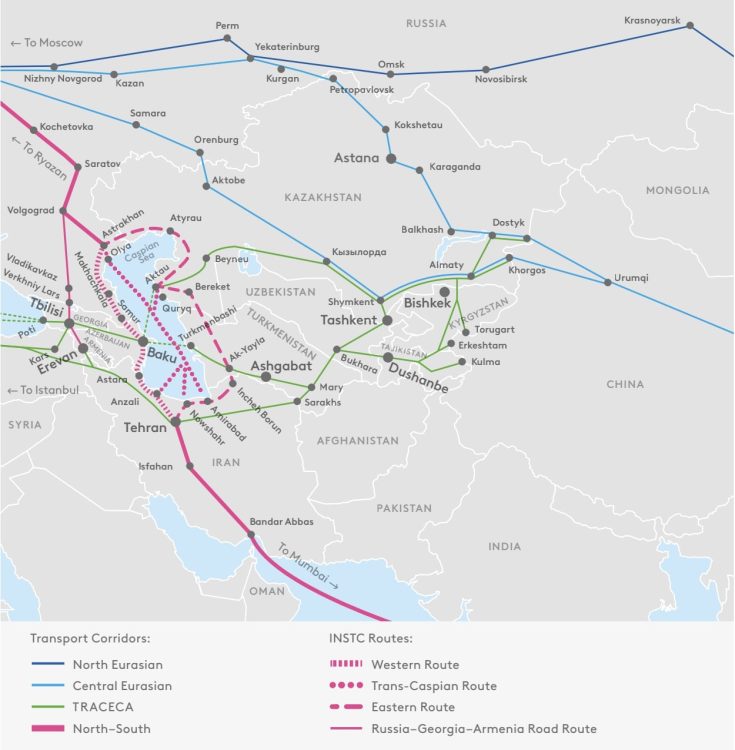

The question, then, is whether Europe is exploring this potential. A few months ago, the Eurasian Development Bank, the international financial body led by Russia and other EAEU member states, stated that the INSTC could “easily develop meridional transport links between North-East Europe and South Asia and create new transport and logistics chains along the interconnected Eurasian international transport corridors”, that will not be limited to Russian involvement”.

A few days later, the European Bank for Reconstruction and Development (EBRD) launched a study to examine the best possible connections between Central Asian countries and the European TEN-T network. The study will last until the summer of 2023 under EU Commission funding and targets identifying optimal alternatives to the northern rail route via Russia. However, this study focuses mainly on the Middle Corridor, not the North-South axis. This makes sense since crossing Iran is unavoidable if you want to transit via the INSTC. However, Iran is also sanctioned by the EU; thus, trade and other business possibilities are limited.

In conclusion, the Central Asian transport market seems to be dominated by Russia and other benefiting partners currently. The EU should be cautious in this sense and maybe quicker when it comes to decision-making related to investments and partnerships in the region. That is because it shouldn’t miss crucial economic opportunities arising there. Maybe possibilities are limited when it comes to Iran, for instance, yet, the remaining markets in Central Asia and the Caucasus could help diversify its trade relations.

Follow RailFreight.com on Google News and get the latest industry updates.

Also read:

- Something is moving in Central Asia with Agroexpress rail services

- EU scrambles for Central Asian connections, a response to growing Russian presence?

- EDB: ‘INSTC potential not limited to Russian involvement’

-

Transport blockade could cost Armenia’s INSTC position and strengthen Azerbaijan’s

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer

The only reason that BRICS would not be involved in the INSTC would be China’s hesitation to jeopardise its Belt and Road Initiative by allowing more space for India to grow and become influential in the region.??

India is the biggest beneficiary of Chinese development loans and its peaceful development will greatly aid China’s.

The hostility is entirely manufactured by the Indians, who have never gotten over the thrashing they received in their border war.