Are England’s ports ready for a shift to rail?

The UK government has mandated a net-zero carbon economy by 2050. However, with Britain’s trade largely conducted through the country’s ports and most forwarding undertaken by road, is the maritime industry ready to answer the call and switch to rail?

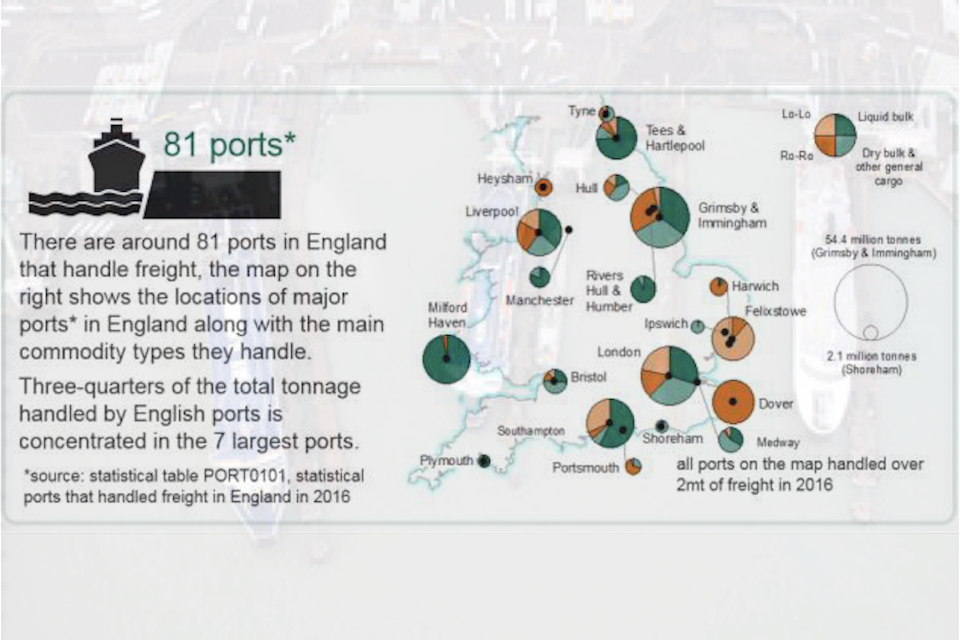

UK government figures show that around 95 per cent of British trade passes through the UK ports. Much of that tonnage is moved on by road, despite significant development of the rail freight network. What needs to be done to make British port operations net-zero in time for 2050?

Studying connections to inland businesses

Money has been put into port connectivity. Projects such as the curve north of Ipswich, which facilitates traffic from Felixstowe, and the much larger project to upgrade lines around Ely, are evidence of that effort. Recently, a series of works to improve capacity and efficiency at Southampton brought a warm welcome from the industry.

A study, Better Connections to Ports, launched by the UK government in 2018, looked at ports connectively in general, helped influence funding, policy and planning decisions by highlighting the importance of England’s harbours and their global trade links. It also looked at how ports can flourish by improving connections to inland businesses.

Investment improving port access

As the UK government has admitted, there is still a much bigger budget allocated to road development. “Extensive government investment is already improving port access, unlocking private sector investment and economic growth across the country”, said the government’s Department for Transport at the time.

However, despite 235 million pounds (275 million euros) invested between 2014 and 2019 to improve rail links, according to the government, there were 23 billion pounds (27 billion euros) invested in providing better journeys on England’s roads. Sources will argue that rail network investment has increased significantly in the past three years, but the obviously greater funding for the road network points to a much bigger swing still required.

More reliability and greater choice

Nevertheless, the maritime industry is responding positively. John Bailey, the managing director for intermodal and terminals at Maritime Transport, says his company, well known for its large road fleet of heavy goods vehicles (HGVs), plays a part in the switch to rail. “Increasing our capacity and logistics efficiency for our customers whilst reducing the need for our HGVs to travel millions of miles each year has always been a vital part of our strategy”, he said. “Our latest intermodal service has been introduced following high demand, and really underpins Maritime’s drive to offer more reliability and greater choice to the market.”

Andrea Rossi, the chief executive at DB Cargo UK, puts some perspective on the task at hand. Speaking about recent developments at Felixstowe, where his company has worked in partnership with Maritime, he is proud of moving around sixteen trains daily on behalf of their logistics partners. “This once again is a testament to the successful partnership we have forged and reinforces our commitment as the industry focuses on modal shift.”

However, while innovation has helped move many bulk loads by rail, the ever-rising tide of intermodal traffic remains dominated by road transfer. If Britain is to meet the government net-zero carbon targets, there is still much to do in the logistics industry. The challenge begins at the quayside.

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer