Despite all odds, rail freight grows in the UK

Despite the pandemic and the Brexit, rail freight in the UK recorded growth of over two per cent in the third quarter of 2020. The latest official quarterly figures from the Office of Rail and Road, the independently appointed industry watchdog, reported a total cargo of 4.07 billion tonne per kilometres moved in Q3. This indicated an increase of 2.1 per cent compared with the same period in 2020. Total freight lifted increased by 12 per cent to 17.8 million tonnes. It is a positive proof of the contribution the industry has made to the resilience of the UK economy during the pandemic.

The statistical analysis of the rail freight sector could be considered a bellwether for the UK economy as a whole. Much has been said about the role of rail freight during the pandemic, especially in the ability of the sector to cope with the wider disruption to the supply chain.

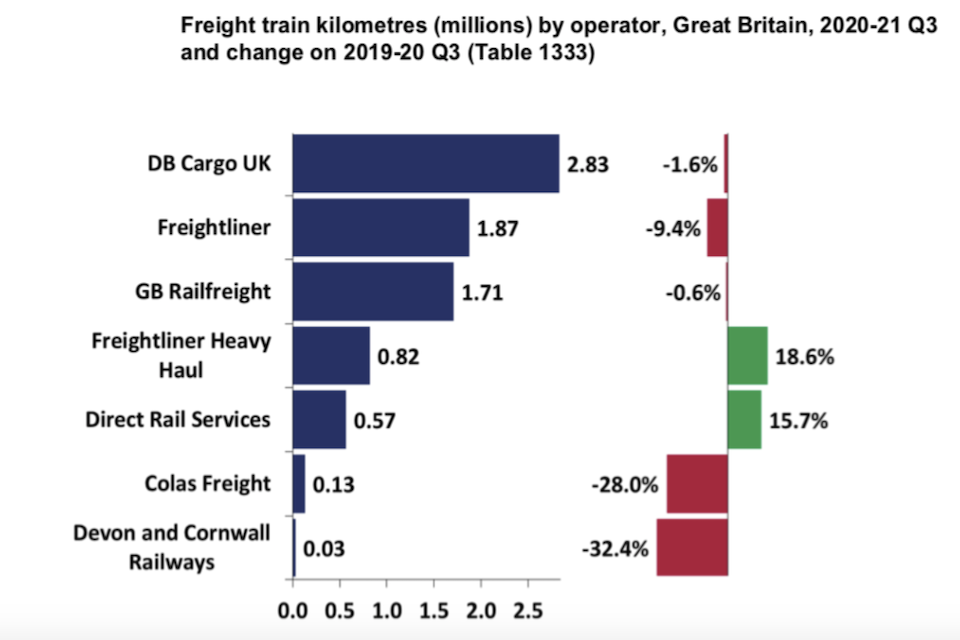

However, despite these figures, freight train kilometres dropped by 1.4 per cent in Q3 compared with the same quarter the previous year, falling to 8 million kilometres. Although the rails were not nearly as clear of passenger traffic as in the first few months of 2020, punctuality remained impressive. The proportion of freight trains arriving within 15 minutes, as measured by the ORR Freight Delivery Metric, reached 94.7 per cent – an almost unprecedented performance.

Oil volumes down

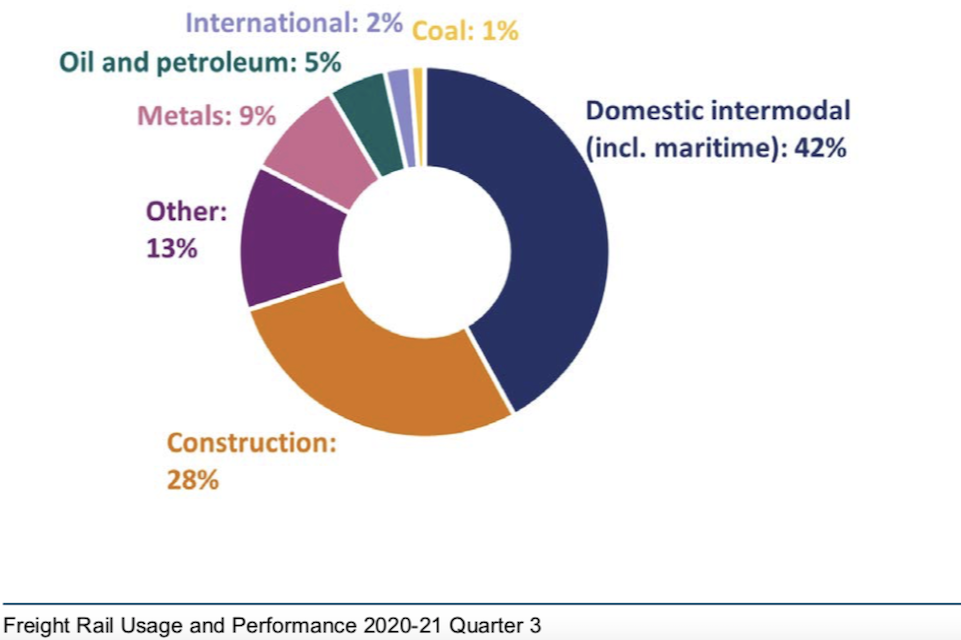

According to the ORR, there was a significant fall in oil and petroleum movements. Volumes dropped 17.6 per cent compared with the same quarter last year. This may seem counter intuitive, until the almost complete suspension of passenger aviation is taken into account. Rail-supplied fuel to airports, notably Heathrow, is almost at a standstill. The ORR say this led to oiI and petroleum having the biggest decrease in market share compared with the same quarter last year, falling by 1.2 percentage points to 5 per cent.

It was international volumes moved however that had the biggest moves – a reduction of 16.1 per cent. The ban on freight movements across the Channel 20 – 22 December, by the French government, and the delays caused by associated Covid testing are likely to have impacted the international volumes, speculates the ORR. Domestic intermodal, which has the largest share of freight moved (currently 42 per cent), there was a 2.3 per cent increase in the volume moved. ORR say this may have been more, except for the congestion at deep sea container ports this quarter.

Operators praised by RFG

Commenting on the figures, Maggie Simpson OBE, director general of the UK industry’s representative body, the Rail Freight Group, took account of the challenging circumstances. “Delivery growth during one of the most economically challenging periods is a real measure of rail freight’s success. Customers are committed to increasing their sustainable transport and consigning more by rail, and this is reflected in these results.” Simpson also made comment during her participation in last Friday’s RailFreight Live UK Special.

The period between October and December 2020 covered both the second UK lockdown and the run-up to the end of the Brexit transition period, adds a RFG statement. These factors, they say, have created significant uncertainty for businesses and disruption throughout supply chains, and rail freight operators have needed to act flexibly and responsively to meet the changing needs of their customers.

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer