Russia-Ukraine crisis: is this the armageddon of Europe-China rail?

Scenarios around the consequences of an armed conflict between Russia and Ukraine have come and gone lately. So far, Russia is not buckling under Western pressure while the US and EU are ready to impose harsh sanctions in case of a conflict. With Russia being an essential part of the New Silk Road, could these developments impact Europe-China rail freight?

In a previous article, Railfreight.com examined the possible outcomes of the increasing political and military tension between Russia and Ukraine. These included the possibility of the US and EU imposing sanctions on Russia as a means of pressure to step out of Ukrainian territory if war occurred.

However, the West seems to have its hands tied behind its back in this case since Russia might come out untouched from such a development. On top of that, the backlash of sanctions on the European economy could prove devastating. Chris Devonshire-Ellis, founder of the Dezan Shira & Associates advisory company, provided some insights on what could happen.

Europe is cut off from China

Devonshire-Ellis highlights how the US threatened to impose “the mother of all sanctions” on Russia, with the EU and UK following the same example. If the EU imposes sanctions on Russia, this will mean cutting off the supply of necessary goods to Russia. Such a move would significantly impact the Russian economy, but it would not leave it without alternatives. Russia could focus more on trade within the Eurasian Economic Union (EAEU) and Belarus, Armenia, Kazakhstan and Kyrgystan. Most importantly, it could cut off rail freight links from China to Europe.

“Sanctions placed by Brussels on Russia could have the effect of slowing or stopping the bilateral trade flows currently operating between China and Europe as Moscow could organise a go-slow or a complete halt in transiting freight. Fifty per cent of all EU bound rail freight traffic enters via Russia and Belarus. That traffic rose by 30 per cent in 2021,” explains Devonshire-Ellis.

What is more, the relations between China and the US are not the best, while China and Russia seem to get along. This means that the possibility of China indeed slowing rail freight to Europe and building stronger trade ties with Russia is quite realistic.

BRI dominates supply chains

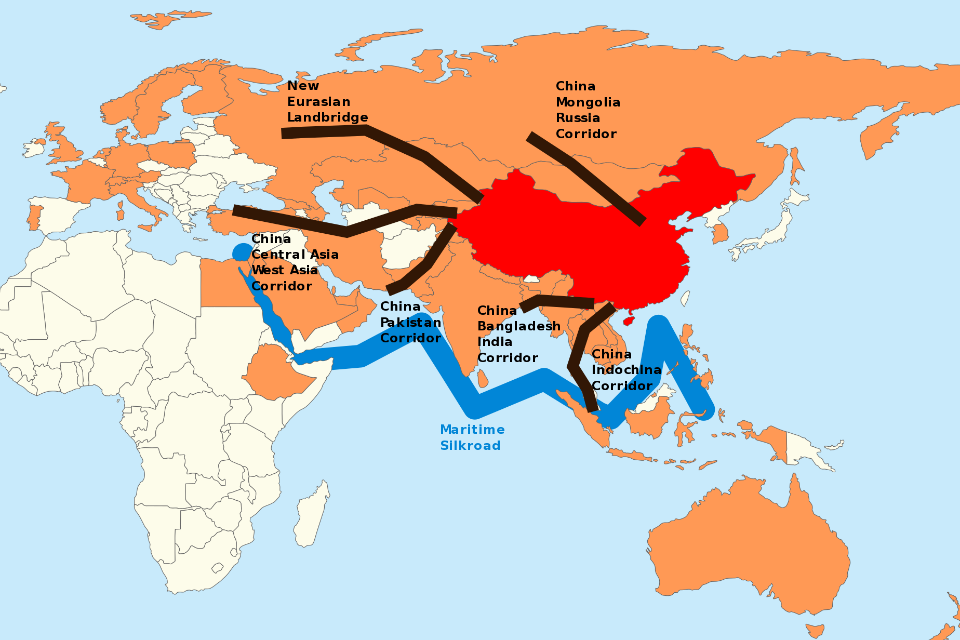

On the other hand, if the US and EU impose sanctions on China, we could see a BRI project more centralised than ever, leaving the West with minimal trade options. Devonshire-Ellis says that “Beijing is highly aware that whatever sanctions the United States places on Russia could later be imposed upon China”. It is prepared for this scenario and seems to have the upper hand.

What does it mean? “China’s Belt and Road Initiative can be viewed as one gigantic alternative supply chain route map with all roads – except those from the United States and EU – leading to Beijing. 144 countries have signed off China BRI memorandums of understanding, all of which include trade references,” underlines Devonshire-Ellis.

Can we imagine such a supply chain? This would be a pure power show-off where each party imposes sanctions and retaliates while centralising trade links by creating spheres of influence that exclude the opposition party. With Europe having to lose the most, the balance is quite fragile.

In this case comes to mind what Frans-Paul van der Putten from the Clingendael Institute mentioned during the European Silk Road Summit last December: “Europe needs to draw its own policy and stop being US’ crutch. If the EU manages to become politically independent, then it will also be able to acquire a better position in the global supply chain without relying on third-party developments”.

Also read:

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer