Quarterly figures make lacklustre reading for UK rail freight

Freight transport in Great Britain suffered a sharp decline in the last quarter of 2022. That’s according to the latest data released by the Office for Rail and Road (ORR). The figures show that 3,70 billion net tonne-kilometres of freight were moved between October and December, a sharp decline of nine per cent compared to the same period in 2021. This is the lowest level of freight moved between October and December since the current ORR monitoring series began in April 1998.

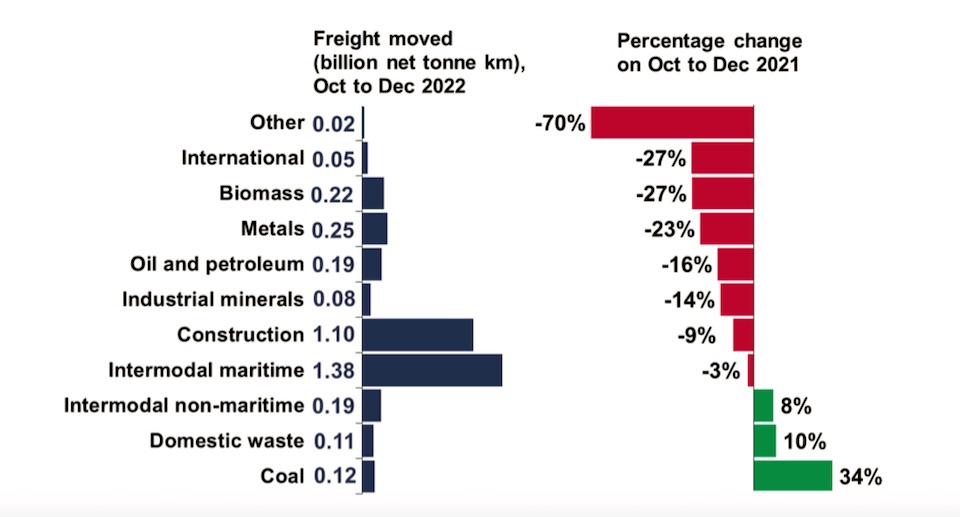

Most commodity groups saw a decrease in freight volumes compared to the previous year. Construction, which has been a success story for rail freight, accounted for 30 per cent of all freight moved in the quarter but recorded a nine per cent drop, in line with the overall figures. Even intermodal maritime, which accounted for over a third of all freight moved between October and December, saw volumes down by three per cent. Volumes of metals and biomass also fell by almost a quarter and just over a quarter, respectively.

Supermarket sweep saves the day

Looking at some specifics in the rail freight manifest, there were some fluctuations which may be considered significant. The nine per cent fall in the construction sector may have suffered from some external factors. Some key freight routes were affected by strike action, such as routes carrying aggregates on the Hope Valley line and the Mendips. This fall in volume may have been partially offset by increased freight movements related to the HS2 construction, such as the removal of tunnelling spoil.

Volumes of metals fell by almost a quarter compared with the previous year. The low levels of automotive production and the flattening of construction output are likely factors in this downward trend. The total of 0,25 billion net tonne-kilometres was the lowest volume reported since the beginning of 2009. Biomass volumes, served by the Drax power station complex in North Yorkshire, also decreased, by just over a quarter, but the good news was inland intermodal. The non-maritime element of container traffic was one of just three measured commodities to show an increase with volumes, up by eight per cent. High levels of supermarket traffic may be a contributing factor with many UK retailers experiencing strong trading over Christmas.

Declining punctuality

The decline in freight transport may be attributed to several factors, including economic uncertainty, strikes across the industry, and a modal shift to the road. The strike action significantly impacted the industry, as fewer days were available to transport freight due to the Network Rail signallers’ strikes taking place each month of the quarter, and some key freight routes were affected by the strikes. As a result, there was likely a modal shift to road.

The Freight Delivery Metric, which measures the proportion of freight trains arriving within 15 minutes, also saw a sharp decline, reaching a record low of 80,0 per cent. Even excluding the quarter most heavily impacted by the pandemic (April to June 2020), freight train kilometres were at their lowest level since April 2020.

Coal, shortages and siding idling

Coal was the only commodity to record an increase, with a rise of over a third compared to the same quarter in the previous year. Of course, transported coal is a shadow of its former volume, with the overall load greatly reduced. This was due to the stocks of coal being accrued at the legacy coal-fired power stations at Ratcliffe, West Burton, and Drax, as a contingency in the event of winter power shortages. Domestic waste also saw an increase of 10 per cent, which was a return to the level seen in 2020.

The decline in international volumes was also significant, falling by just over a quarter. This was attributed to low levels of automotive production caused by electronic component shortages. That may have hurt flows like the Toton to France route, and exports via Southampton. Uncertainty over domestic supply chain, such as the troubled battery factory site in the North East of England, may prove a long-term concern for the future of the automotive sector,

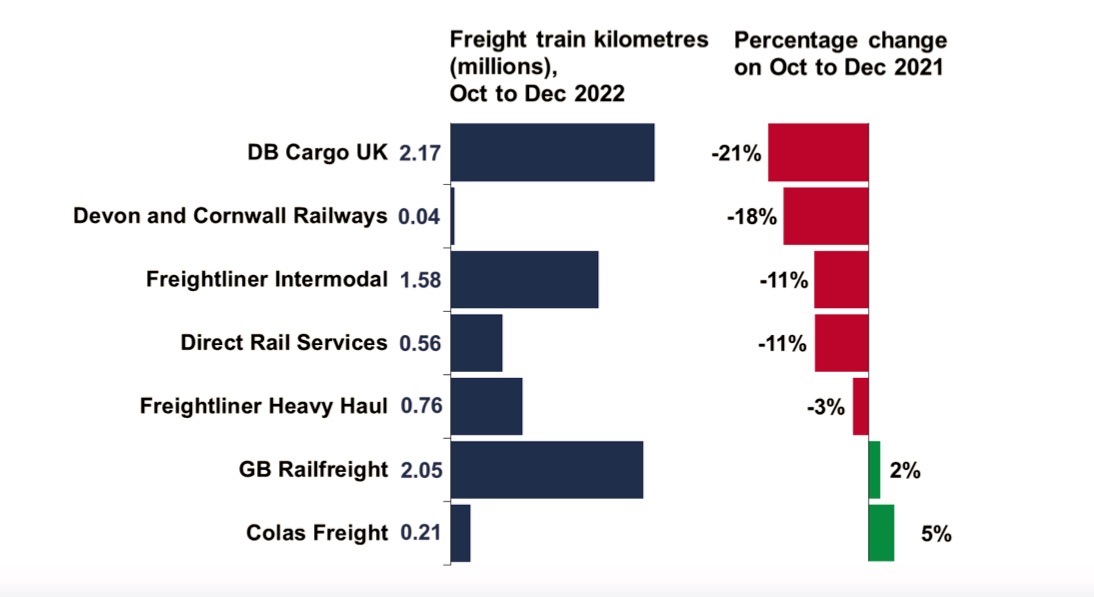

The ORR figures did reveal that most freight vehicles were standing idle in sidings for more than most operators would like. Freight operators recorded 163,47 million freight vehicle kilometres in the quarter. That’s a decrease of 10 per cent compared with the same quarter the previous year. Of the seven operators routinely surveyed by the ORR, only GB Railfreight and Colas Freight recorded an increase.

All other modes, those handsomely rewarded by willingly paying clients, are upgradeable, for added load – and for lower costs, etc.

Short of sound, sustainable redundant capacity, now high steel quality, at rails etc., just moves Weak Link, within railway system.

Symptom, added costs for repairing (“attending maintenance”…) now is attended, by maintaining, by restoring…

Margin for future added load, is not redundant, but urgently needed!

70 kip shall be axial load, min constructed for, etc.!