Is the Russian railway industry facing a crisis?

The Russian railways sector may face the deepest crisis in its modern history. The ongoing war between Ukraine and Russia and unprecedented sanctions imposed on Russia may throw back the industry for decades. However, there are sectors of growth too.

Export hit hardest

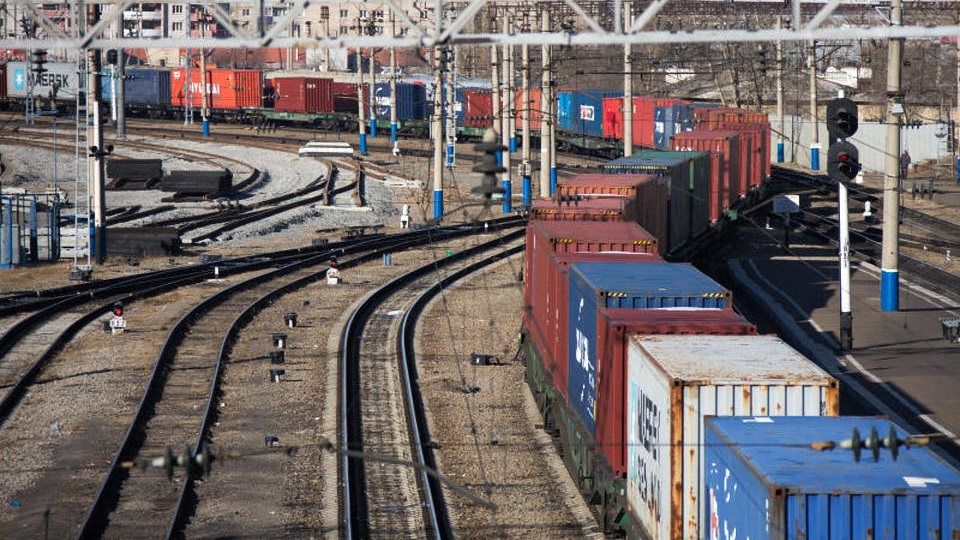

So far, Western sanctions have already led to a significant drop of cargo traffic on Russian railways, particularly on its outbound flows, which fell by almost 16 per cent, year-on-year.

The biggest drop was observed in the rail export of timber (by 44,7 per cent), iron ore (by 42,9 per cent) and fertilisers (by 40,8 per cent). The main reason for this is the loss of major Western export markets by Russia.

Reorientation?

Currently, the Russian Railways division RZD together with shippers have already begun reorienting part of the export cargo to alternative directions, although successful implementation of these plans may take place up to several months. According to analysts of RZD and some independent Russian analysts in the field of railways business, part of this cargo could be primarily redirected to domestic markets and some Asian routes.

RZD itself does not give an official forecast for cargo traffic. The head of the company, Oleg Belozerov, said on 24 May that he expects an overall decline of 5 per cent this year. Earlier, the Russian media also reported that the deficit of the investment program of RZD will vary in the range of 220-246 billion rubles (EUR 3,27-3,66 billion), despite the additional capitalisation of the monopoly from the Russian National Welfare Fund for 250 billion rubles and another 120-160 billion rubles, which are planned to be obtained through various measures and sources, including tariff ones.

Positives for wagon building

In the meantime, unlike cargo transportation, the current situation in the segment of wagon-building in Russia is doing much better, as it is rapidly recovering after a sharp drop at the beginning of the current year.

As of now, the segment has dropped by 40 per cent year-on-year, whereas in February its decline was equivalent to 90 per cent. Analysts of RZD expect the production of rail cars in Russia for the entire year may generally comply with the figures of 2021.

Purchasing continues

As representatives of RZD said in an interview, they plan to continue purchasing rail cars for their needs this year, despite the current crisis. For the current year, the company plans to purchase 868 passenger cars, including 325 for long-distance transportation, 403 for suburban and 140 cars for Lastochkas high-speed trains.

Implementation of these plans will be part of RZD’s existing rolling stock renewal programme. The company plans to complete implementation of the programme in full, despite warnings of some analysts that the rise in the cost of rolling stock will lead to a drop in the physical volume of deliveries.

Transmashholding

That will ensure additional orders to leading Russian wagon-builders, such as Transmashholding, which is especially important amid the conditions of the crisis in the industry.

A spokesperson of Transmashholding in an exclusive interview said it continues the design and supply of new products for the needs of its major customers in Russia. One of such products is TEM23, which is the latest four-axle, two-diesel shunting diesel locomotive designed to perform shunting and shunting operations on 1520 mm gauge railways, which tests have recently begun in Russia.

Sinara Group

In the meantime, representatives of Sinara Group – another leading player in the Russian railways sector have said that despite all the existing difficulties and problems, the company continues its operations.

The company’s spokeswoman has confirmed that currently all enterprises of the holding are operating without any interruptions, while the staff of enterprises is retained in full. According to the company, STM does not abandon the implementation of previously announced production and design plans. However, the timing of these projects may be adjusted.

A company spokeswoman comments: “We are currently studying this issue and will be able to provide more insight later, after the relevant decisions are made by the management of STM, and in general after the stabilisation of the socio-political and economic situation in Russia.”

Passenger traffic

There is a possibility that passenger transportations will provide one of the drivers for growth for the Russian railways sector this year. That will be mainly due to a sharp drop of air traffic in Russia both on domestic and foreign routes this year, which is mainly due to Western sanctions and the closure of some airports in the south of Russia, caused by ongoing military conflict in Ukraine. That contributes to the growth of demand for passenger rail transportations, particularly to the Black Sea coast of the country during the forthcoming holidays season.

These trends are supported by official statistics of RZD, according to which passenger traffic on the RZD network is steadily growing. In January-April, it increased by 6,5 per cent, to 331.1 million people, while in April – by 4,8 per cent compared to April 2021. Long-distance traffic grew especially strongly – by 19,2 per cent, to 7,7 million people in April, and by 12,6 per cent in the first four months (to 27 million passengers).

Cloudy future

Still, despite some positive news for the industry, its prospects are cloudy, partly due to the exodus of major Western players.

One of such companies is Siemens, which since the middle of May has begun suspending its work in Russia. As part of this the German concern is withdrawing from joint ventures and is terminating service contracts with RZD, in particular, for the maintenance of Sapsans, the Russian gauge high-speed electric express trains.

According to experts, even in case of ensuring of technical servicing of these trains in Russia, their provision with components will be a serious problem and, most likely, will be solved by disassembling part of the fleet for spare parts, as is already happening with aircrafts. At the same time the situation with Siemens’ joint venture with Russian “Ural Locomotives”, which produces “Lastochka’s”, a German/Russian commuter intercity electric multiple unit train used across multiple Russian cities, is also unclear.

Also read:

- Russia-China increase freight traffic while new rail line is almost operational

- 150,000 inactive wagons create chaos on Russian railways

-

Russian Railways hikes freight rates by 11%, but not for all cargo

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer