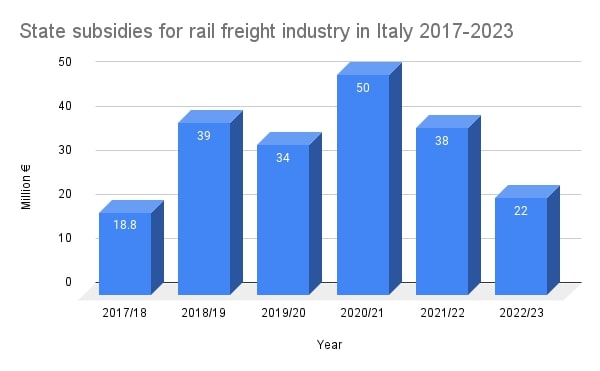

Italian state subsidies for rail freight are the lowest since 2018

For the period 2023-2027, Italy’s state contributions for the rail freight sector are set at 22 million euros per year. This is the lowest amount since 2018. This number, therefore, represents somewhat of a step back since it is the same amount that was dispensed in 2011.This is one of the conclusions of the annual report for the industry 2022, presented by Fermerci, the largest Italian rail freight association.

RailFreight.com had a chat with Giuseppe Rizzi, Fermerci’s general manager, to understand what the main takeaways were and what can be done in the future to further improve the sector. Rizzi recognised the fact that state incentives did help, to a certain extent, the Italian rail freight industry. In 2019 these incentives amounted to 39 million euros, in 2020 to 34, in 2021 to 50, and in 2022 to 38. The sharp increase in 2021, as Rizzi pointed out, was due to the impact of the COVID-19 pandemic and the Russian invasion of Ukraine.

One of the main complaints brought up by Rizzi is the difference in state incentives between the road and rail freight sectors. To better contextualise, 25 million euros were allocated as state subsidies for the road sector just for the period between 3 October and 16 November 2022. On the other hand, the rail industry is getting 22 million on a yearly basis for the next three years. According to Rizzi, these subsidies should actually keep increasing because a growth in volumes means more costs for the sector. Moreover, these subsidies should be viewed as investments, considering all the advantages that the rail brings.

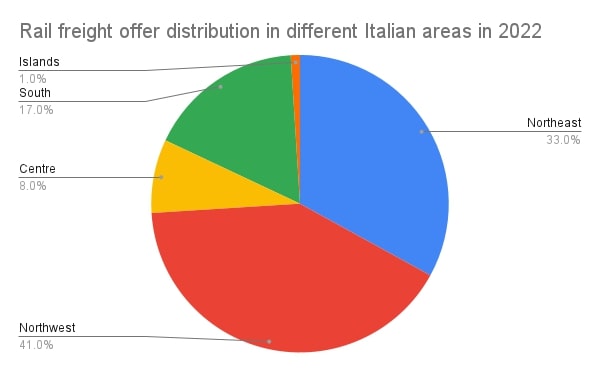

The difference between north and south is still astounding

Another highlight from Fermerci’s report is the staggering difference between the offer in the north and south of Italy. Nearly three quarters of the rail freight services available in Italy are in fact carried out in the north, with only 26 per cent of the being in the centre, south and islands. As explained in the report, the northwest and especially the northeast were the areas in Italy that experienced the largest growth in terms of train/kilometre between 2018 and 2022.

One of the solution proposed by Rizzi to boost rail freight in the south would be the construction of more rail terminals along the Adriatic and Tirrenic routes. Especially on the latter, Rizzi pointed out that the majority of the facilities along these lines are saturated and do not have the capacity to handle additional volumes. However, he underlined that there are no concrete projects to implement more terminals in these areas.

All other modes, as robust (resilient and redundant) upgrade for added load and lower costs and – by willingly paying clients-handsomely are rewarded.

Railways, regrettably stuck at standards, neither with margins for future demand – nor withstanding to days traffic and speed…, is devastating – for Industry and for all, except a minority ( including share owners at global truck producing facilities).