UK economic picture reflected in rocky rail freight stats

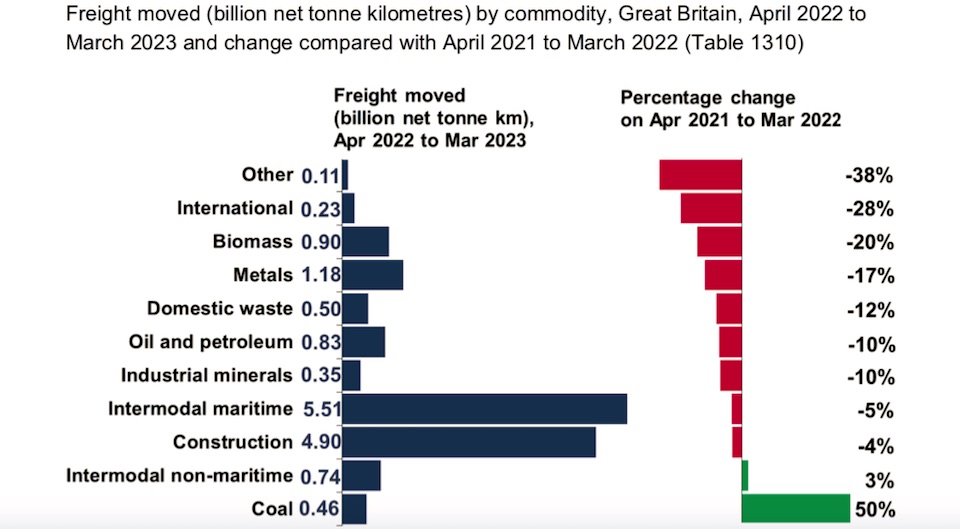

In its quarterly review, the Office of Rail and Road has revealed statistics highlighting the impact of the UK’s economic position on freight rail usage and performance from January to March 2023. The data indicates a significant decrease in freight moved, dropping by seven per cent compared to the previous year. Strike action further contributed to the decline, limiting the available days for freight trains to operate normally. Construction freight experienced a four per cent decrease. However, there was a notable increase of fifty per cent in coal volumes due to rising gas prices and preparations for potential power shortages.

In the period of January to March 2023, rail freight traffic in Great Britain experienced a seven per cent decrease, amounting to 15,73 billion net tonne kilometres compared to the previous year. The majority of commodity groups recorded a decline in freight volumes, likely due to strike action limiting available operating days for freight trains. Notably, intermodal maritime freight saw a five per cent decrease, reaching its lowest volume in nine years, despite having the largest share (35 per cent) of all freight moved between April 2022 and March 2023.

Coal volumes surged

The latest statistics from the Office of Rail and Road show an almost across-the-board fall in rail freight activity. Construction, which accounted for 31 per cent of all freight moved, witnessed a four per cent decrease. However, it still marked the second highest volume since April 1998, largely attributed to substantial deliveries made to HS2 construction sites during the quarter – underlining the impact of that vast high-speed rail project. Conversely, volumes of metals dropped by 17 per cent, hitting the lowest value since data collection began, while biomass and oil and petroleum experienced declines of 20 per cent and ten per cent, respectively.

Amidst the varied trends, intermodal non-maritime freight stood out with a three per cent increase, representing one of the two commodities groups that saw volume growth. The most significant percentage rise was observed in coal volumes, which surged by 50 per cent and reached the highest level recorded in four years. Although a relatively small weight overall, and a tiny fraction of historical levels, this increase was driven by rising gas prices and the UK energy distributor, National Grid, making preparations for potential winter power shortages, leading to an increased demand for coal transportation.

Signs of a more stable pattern

Overall, the total volume of freight moved in Q1 2023 was 4.07 billion net tonne kilometres, reflecting a three per cent decrease compared to the same quarter in the previous year. Strike action throughout the industry further impacted freight operations, resulting in fewer available days for transportation. However, it is worth noting that the number of strike days was lower than in the previous quarter (October to December 2022).

Intermodal maritime freight remained relatively stable during the quarter compared to the previous year. Accounting for over a third of all freight moved between January and March, it exhibited signs of returning to a more stable pattern, particularly in deep-sea container shipping. Construction freight constituted a third of all freight moved in the quarter, witnessing a six per cent increase and reaching its highest value since April 1998.

While several commodities experienced decreases, intermodal non-maritime freight registered the largest increase of 18 per cent, bolstered by the introduction of new daily domestic intermodal services. On the other hand, domestic waste saw a decline of 17 per cent due to decreased packaging waste resulting from lower levels of non-food consumer goods purchased online during and following the pandemic. The next survey is due in late September.