Wagon keepers want more support for quiet trains

With quiet routes covering a considerable part of the European railway network post-2020, wagon keepers are bound to invest in the phasing out of noisy trains. However, wagon keepers do not necessarily reap the economic benefits of these investments. Despite several supportive measures, companies feel that more must be done.

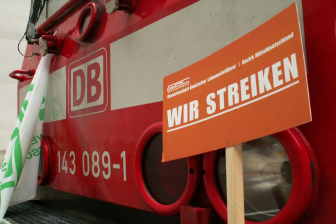

The European Railway Agency (ERA) currently considers implementing quiet routes, where only retrofitted trains may pass. It has consulted the market in the first quarter of this year and will take a decision on this measure by the end of 2018. Although the detailed implementation is not yet clear, quiet routes already exist in some places and are expanding. Most notably, noisy trains are banned from the entire railway network in Germany from 13 December, 2020. With regulation like this, retrofitting becomes inevitable.

Investments

Wagon keepers have come to realise the neccesity of retrofitting, and are investing heavily in new technology for their existing fleet. Railcars are equipped with silent brakes blocks, which should reduce the level of noise produced. But these retrofitting measures are not the least expensive. For example, railcar leasing company GATX makes available more than 10 million Euros to convert existing freight railcars into silent freight cars fitted with whisper brakes, it revealed. Other companies make similar investments.

“Switching to noise abatement technologies involves a significant investment for wagon keepers. Various noise protection support programs offer incentives to convert existing wagons to composite brake blocks at an early stage. Nevertheless, many companies feel that more needs to be done”, said wagon hire and rail logistics company VTG. A German-based company, VTG is particularly affected by the German rules and runs an active retrofitting programme, having adjusted more than 20 per cent of its fleet now.

Supportive measures

Wagon keepers are not on their own when it comes to making investments. For example, they can apply for funding through the Connecting Europe Facility (CEF), explained Robin Middel, spokesperson of the Dutch Ministry of Infrastructure and Water Management. “Wagon keepers can get subsidies covering 20 per cent of the costs of LL break blocks. A few calls have already been announced and 20 million Euros has been made available, while the maximum fund for this purpose is 260 million Euros. Another call may be announced.”

Support also exist on a national level. For example, the German Federal Ministry of Transport and Digital Infrastructure offers a one-time support of up to 844 Euros for the conversion of each wagon”, explained VTG. In addition, it is legally possible for infrastructure managers to include a malus or bonus in the track access charge for the use of retrofitted good wagons since 2015. This voluntary measure was adopted by Germany, Switzerland, Austria and the Netherlands. However, these bonuses benefit the companies operating the wagons, rather than the wagon keepers.

Not enough

According to GATX, the supportive measures help the company to keep prices increases as a result of retrofitting to a minimum. The company obtains support by the EU fund for retrofitting the existing fleet with low-noise brake blocks, in addition to several national funds. “Funding instruments such as from the European Union can significantly accelerate our efforts. Through such supportive measures, higher lease prices from retrofitting can be held to a minimum”, it stated.

However, many wagon keepers feel that despite supportive measures, the financial burden for wagon keepers is still too high, according to VTG. “The Association of Freight Wagon Keepers in Germany (VPI), among others, considers various factors of the existing support program (in Germany) to be problematic. VTG is pressing for simplified and more effective retrofitting support in order to not jeopardize the competitiveness of this environmentally-friendly mode of transport.”

Price increase

“Innovations must generate commercial benefits for wagon keepers. For this to happen, the total life cycle costs must be lower than in the past or there must be scope to pass the incremental costs on to the transport market, in part or in full, in the form of rents or offsets”, explained the Technical Innovation Circle for Rail Freight Transport (TIS) on its website.

Inflating prices for leasing or selling retrofitted cars are a sensitive matter for wagon keepers, as they are dependent on market mechanisms. The market must be able to bear the price increase, and other companies must take similar steps for competition to remain fair. Another possibility for wagonkeepers to recover the costs is by agreeing that that bonuses provided for the use of quiet trains are paid to the wagon keeper, explained Middel. “Wagon keepers can include in the contract that this bonus is forwarded, or the wagon price increased.”

More support

GATX said to retrofit up to 10 existing railcars every day. By 2020, all their freight railcars operated in Germany will be fitted with whisper brakes. “GATX is making significant investments into the digitalisation of its fleet and thereby to contribute to make rail freight more attractive and more competitive”, the company said. Similarly, VTG’s objective is to fit a further few thousand wagons with k-brake blocks by 2020. “Around five percent of all Germans are affected by rail noise and solutions for freight traffic are particularly sought-after. In order to relieve the burden for people, VTG is continually extending its dedication to noise abatement on the rails.”

Yet, innovations should not jeopardise the compatibility of the freight cars deployed in Europe, warned TIS. “The market for new rail freight cars in Europe is small. As a result, the development costs for innovations are relatively high compared with the quantities likely to be sold. Moreover, in number terms there is only moderate market demand for freight cars. This is compounded by the fact that wagon manufacturers are insufficiently resourced financially for developing basic innovations.