Smart device production most affected by coronavirus

Smart devices such as phones, TV’s and watches are among the products to be most affected by the outbreak of the coronavirus in China, which has paralysed the logistics industry. In general, original design manufacturers (ODM) are impacted more than manufacturers importing parts from China . This is the expectation of TrendForce in a report on the expected impact of the coronavirus on various technology markets.

The US-based firm investigated key component and other downstream technology industries under the impact of the COVID-19 outbreak. “Companies in China are forced to reduce or stop their production, which has consequences for the availability and prices of end products.” According to the company, the downstream ODMs and brands in the supply chain are undoubtedly hit the most by the coronavirus outbreak.

“These companies lost precious working days after work resumption was postponed. After their production is resumed, on a whole, operators’ work resumption rate is low. Besides, all types of materials and components are in shortage. Hence, productivity plummets.”

Watches, notebooks and TV’s

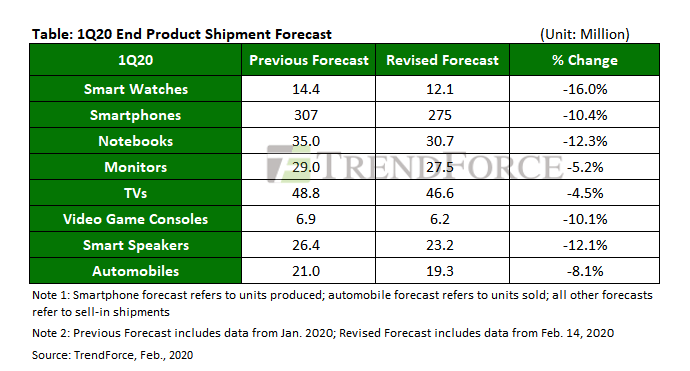

According to the report, smart watches are expected to get the hardest hit, with a decline in unit sale of 16 per cent. “Product assembly of smart watches, smart bracelets, and TWS Bluetooth earphones primarily takes place in Guangdong, Jiangsu, and Zhejiang. In spite of the projected mid-February work resumption date, work stoppages, labor shortages, and material shortages can bring about a decline in 1Q20 production volume, with deferred releases of new products originally scheduled for 1H20 release”, the report reads.

Manufacturing processes and demand for materials are similar tor TVs and monitors. In 1Q20, the TV set shipment is predicted to fall from previous prediction (48.8 million units) to 46.6 million units because of the outbreak. The monitor set shipment is projected to decrease from previous prediction (29 million units) to 27.5 million units.

“To assemble a notebook set requires complicated key components. At the current stage, notebook’s batteries, hinge, and PCB already experienced shortage or out of stock. This factor might cause some brands’ shipment quantity to remarkably drop from previous prediction (35 million units) to 30.7 million units in 1Q20.”

Automotive industry

At the beginning of the outbreak, a lot of emphasis was on the automotive industry, as many manufacturers of automotive parts are established in the regions most affected, such as Hubei province. However, end manufacturers in Europe have the possibility to shift their sourcing to other Asian countries such as Korea or Japan.

Yet, the COVID-19 outbreak certainly resulted in decreased supply and demand in the Chinese automotive market, TrendForce notes. “The two primary difficulties facing suppliers in the Chinese auto market are work stoppages and uncertain work resumption dates.”

Although automakers can compensate for material shortage through overseas factories, the process of capacity expansion and shipping of goods is still expected to create gaps in the overall manufacturing process, the firm predicts. “TrendForce believes that overseas automakers’ supply shortage will briefly impact market demand; however, after accounting for all market segments, TrendForce expects the 1Q20 global auto market to suffer a 14 per cent decline YoY – the largest decline in recent years.”