European Silk Road Summit live blog: Day 2

On 26 and 27 November the European Silk Road Summit took place. This event, held in the Dutch hub of Venlo, is the third edition of the previously named Silk Road Conference. Over two days, around 300 stakeholders on the New Silk Road gathered to discuss the latest developments on this transport route between Europe and China. This is the live blog of day 2. Also read the live blog of day 1.

1545: And we’re done! Over and out from the New Silk Road Summit 2019 – we’ll see you again in 2020!

Q9 How long from Xi’an to Budapest (days)?

Q8 When was Nunner logistics established?

Q7 To which Kazakh ports do ships form Baku sail?

Q6 Which city is NOT connected to Luxembourg – Nancy or Nice?

Q5 How low can temperatures be on the Northern Silk Road Route?

Q4 Which Chinese city is connected directly to Kouvola in Finland?

Q3 Which product group is most affected by Russian sanctions?

Q2 Which company was the first to ship via the New Silk Road?

Q1: How far is it (first points of entry) between Netherlands and China?

1531 Here it is! The Silk Road Challenge – who will be crowned Summit Champion? Ten questions based on the last two days’ presentations.

1530 Just a note for your diary: 14-15 May 2020, Poznan, Poland for the RailFreight Summit (programme in progress)

1525 The highlight of the event is about to happen…

1520 From the floor – “China’s dangerous goods regime is built around its own infrastructure, and it’s not ready to deal with the loads classified as dangerous.” A point of view that takes some debate and is not shared by all. It’s the point that brings the conclusion to the discussion and the session.

1515 Verbraak: “The Chinese plan is to move major manufacturing inland. It’s designed to help the west of China become more prosperous and take the pressure of the big costal cities. This is a big development of which we have to take note.” Moving inland means that transshipment to reach a deep water port is less economical and makes the Silk Road more viable. Does that mean there will be a wider range of goods cleared to take to the rails?

1507: It seems strange, but the Chinese authorities are more open to road transport for dangerous goods. Pereira de Sousa says opening up trade westwards may drive a change in regulations. “We want to send things like batteries for electric cars to China, and even finished electric cars. When China is in a position to send electric cars to Europe, there will be an economic pressure to relax the rules.

1504: Dangerous goods transport regulations in China vary from area to area, province to province. Advice from the floor is to seek advice and information from your Chinese partners. Regulations can change at short notice.

From the floor – goods not bound for China can go by other routes (with the relaxing of rules in Russia).

1455 Pereira de Sousa: “Security and public safety are behind many dangerous goods regulations in China.” Paints too are a problem, says one delegate.

1453 Verbraak: “Batteries for one are going to become a greater issue with the growth in electric vehicles.”

1450 Hasenkampf emphasises that dangerous goods cover a wide catalogue.

1445 OK – about to get explosive. On the stage Dimitri Hasenkampf (DB Cargo); Miguel Pereira de Sousa (Senator International); and Roland Verbraak (GVT Intermodal)

1430 A few minutes break to get ready for our break out sessions.

1426 Last question of the session – Yingnan Yao of DB Cargo: “If it so sensible (to have mixed loads) why is it not done?” Nagetgaal of Rotterdam says the answer is Chinese subsidies are only available to block trains, not mixed loads. “Think global and act local.”

1424 Perspective from Nagetgaal of Rotterdam: “Between Poland and France there are 1000 rail trucks every day, and that’s just intra-European trade.”

1418 “In our own markets we can outperform the other ports”, says Aliyev from Baku. “In the end, the market will decide”, adds Nagetgaal of Rotterdam. “If the Chinese would send mixed cargo which can be transshipped at the European borders, that would be more reliable and more efficient from the European perspective,” he adds.

1415 Questions cover several angles. Can Rotterdam be biggest in the world again? (possibly not but it can be the smartest, and that draws in clients). Is there a level playing field for European port development? (possible not if development in the south of Europe is subsidised, but it all comes down to transit time).

1410 Steffánski’s closing remark: “Let’s intermodal together.” It’s a message for cooperation between ports. Time for the audience to have their say.

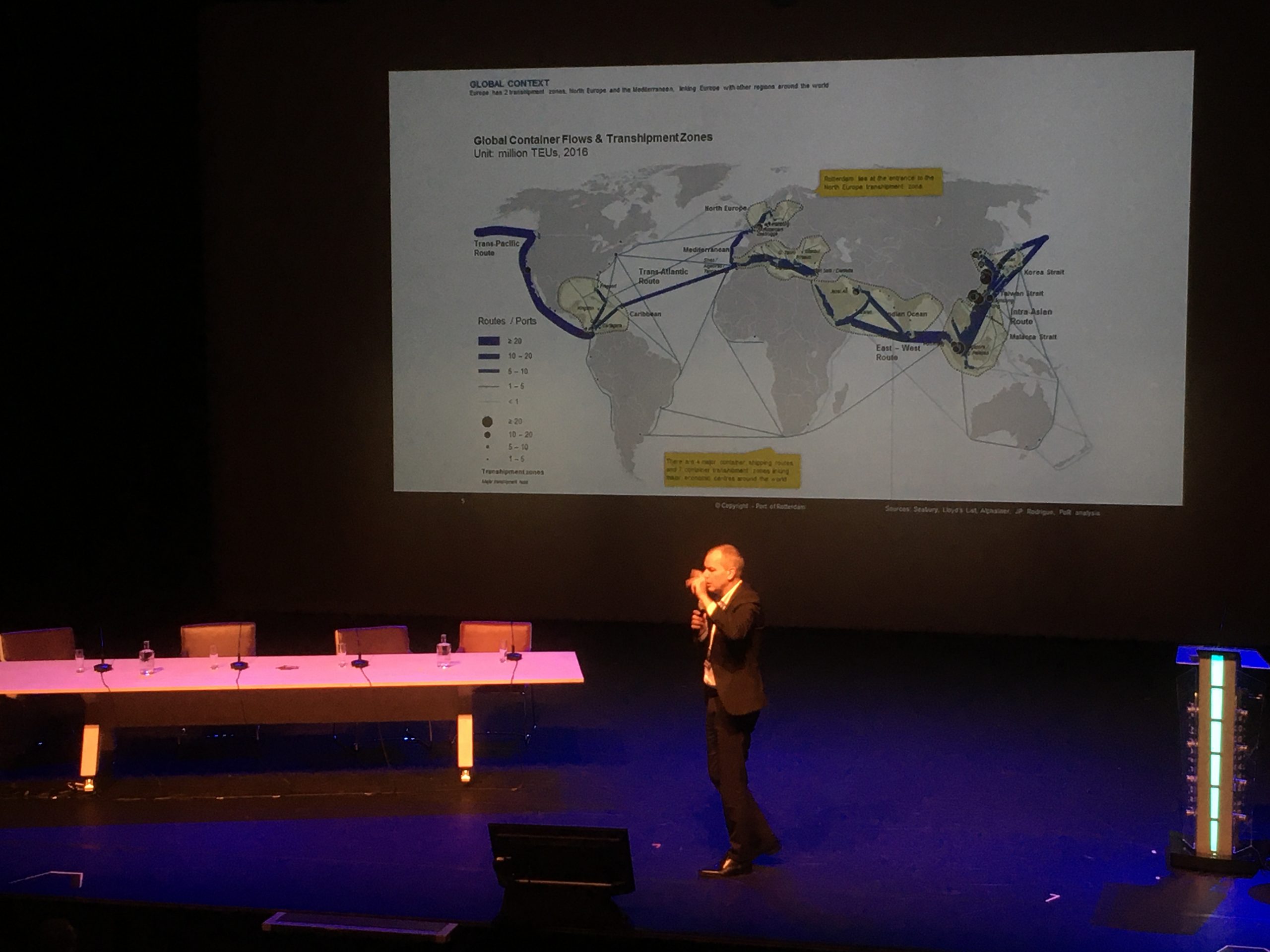

1407 Graphic demonstration of the density of European hubs, compared with Asia. Guess what – Europe is packed solid with intermodal hubs; they’re a rare phenomenon in Asia. Are we over supplied in Europe, or have we got too many that are too small? Is smaller and more local the better European model, since the long trucking routes that are commonplace in China are unacceptable in Europe?

1405 “In China, trucking 1000km is normal. From the Chinese perspective, Europe is small, and they see no problem with delivering a block train to a hub, and trucking individual loads hundreds of kilometres.” Stefánski explains a difference of perspective and what that means for European operators.

1400: Next up, the longest travelled speaker. At least the one with the longest journey: linking Europe with Korea and Japan – through intermodal. Our speaker is Dariusz Stefánski, who is the president of the management board at PCC intermodal, based in Duisburg.

1355 “The geographical advantage and economic advantages are making Baku more attractive” concludes Aliyev.

1350 Aliyev says the Alat Free Trade Zone is playing a significant role in the economy of Azerbaijan and making Baku into an even more commercially attractive port. That’s bringing trade into the country, and that’s making the Silk Road option more attractive.

1345 The capital of Azerbaijan plays a central and increasing role in Silk Road trade. Aliyev’s presentation lays out the geographical and historical context, and brings that up to date with the current trading position, using Baku as a hub. Shorter rail routes and transshipment modernisation across the Caspain Sea, and the Bosporus tunnel have all made Baku more viable. Aliyev says that from Baku, they consider themselves on the ‘middle route’ of the Silk Road (often thought of in Europe as the southern route).

1343 Speaker eagerly anticipated -Tural Aliyev, advisor the director general of Port of Baku- takes the stage.

1342 “The risk of disruption is from north to south, with possible development of southern European ports.” Nagtegaal concludes with a mention of the competition as he sees it in Europe.

1340 “Rotterdam is already well connected to Venlo, Tilburg and Duisburg. Having a direct connection to China would be good but we are already well served by these hubs.” Nagetgaal, as containers manager at the Port says Rotterdam is concentrating on its deep-sea and short-haul rail as its connection to the Silk Road.

1330 Nagtegaal’s presentation starts with a summary of five years’ steady growth at Rotterdam. He says some of that is down to bigger ships (Mette Maersk called a few days ago with 20000TEU on board). Underlying trend – almost doubled handling in the last five years.

1325 Launching the “Connecting the Ports” session, Hans Nagetgaal, director of containers at Port of Rotterdam, poses the question Silk Road: a threat or opportunity for Port of Rotterdam? All our port operator delegates had their seats early for this one.

1320 Straw poll in the hall: is a Silk Road Association a good idea? Yes 25%; Definitely no 10%. Undecided 65%.

1315 We’re back for the final afternoon, with some explosive debate to follow. We’ll be connecting the ports in a moment – which calls for some co-operation, then we’re splitting up for some business speed dating – and a breakout to handle dangerous cargo.

1245: That’s lunch. We’ll be back in about 30 minutes.

1220 Question topics include: Discussion about the readiness of parts of Europe to handle increased Silk Road rail traffic – both logistically and politically? Should there be product specialisation in Europe, as their is in China? The necessity for co-operation between European hubs? Are some countries in Europe missing out on Silk Road because they are not taking the necessary steps to develop infrastructure? Is there a cross-border lobby group or association co-ordinating Silk Road trade policy? Everyone here has input into the debate. What do you think? Do you have questions? Do you have answers?

1215 The jewel in the crown: Kuvola – Xi’an is the subject of a glossy video that ends Simo’s presentation, and opens up the sessions’ Q&A from the floor. No-one asks if terracotta warriors will be using the service.

1210 Backing up the observation that business follows government, there is a Chinese delegation every week in Kouvola, says Päivinen of Kouvola, which just happens to have the largest marshalling facility in Finland. Planned expansion will have the facility to handle 1100 metre-long trains (up from 800m presently.

1207 “37 cities in China have the status of rail hub. That number is to be reduced to around 15 – but we don’t know which ones”, Päivinen says. That may well affect the subsidy framework for Silk Road trade and the North Eurasia Growth Platform upon which he’s working.

1205 Päivinen is the first speaker in this session to make direct mention of the BRI (Belt and Road Initiative – or One Belt One Road as he calls it) and of the trade opportunities along the Silk Road. First port of call, as it were, was Kazakhstan. From that beginning, and it’s been over ten years, he says trade has grown to include many Chinese city regions too.

1200: After the west and south from Luxembourg, let’s look north to where everything is due south. Finland’s Railgate aims to be the Northern Europe hub for China. To make the case, Simo Päivinen, development director of Kouvla Innovation, the development agency for the urban region takes the stage.

1155: “Not forgetting the facility of barge transport for onward shipping”. So landlocked but not river locked in Luxembourg. Governor of Sichuan province was guest of honour at the departure of the first eastbound train. We know what a visit from Chinese government officials means – Chinese business will be keen to follow. “We don’t need to reinvent the wheel,” says Jenayeh about Luxembourg’s position. “There are networks we can use that are already established.”

1146 “Luxembourg is a hidden champion” that’s Jenayeh’s keynote. Logistics, rail and infrastructure are the three pillars of Luxembourg’s offer to international trade, he says. You know, a three-legged stool is inherently stable. That’s no coincidence, we think.

1145: To put the case for Luxembourg, Imad Jenayeh is the senior business development manager at CFL Multimodal, a group of twelve companies in six countries

1143: Regter touches on the subject of reduced subsidies from China. “If there is someone knocking at your door, asking to come to your party, you can do two things: keep the door locked or explore how much they bring to the party. What should we do?” Regter advocates opening the door to Chinese trade.

1140 “It’s not so difficult to start a train. It’s difficult to build that into a reliable service long term.” Regter goes against the physics of railway operations to illustrate the logistics of operations.

1135 “It’s not only to China, its to all the countries in between too.” Regter really lives the spirit of the Silk Road. He’s looking also at other Asian destinations – Vietnam, Japan and Korea among them.

1130: “The true Silk Road.” Regter gets top marks for enthusiasm. He’s a polished performer, and is right up to date with news that they’ve signed a memorandum to develop trade along the routes though Budapest that he calls the true Silk Road, because “they are about connecting hubs all along the route in the true spirit of the Silk Road trade. And yes, they too have signed up with COSCO to help develop hinterland routes.

1125: Eric Regter, whose business card carries ‘authorised representative Sea Port and Benelux at Rail Cargo Group now has the floor to tell us about the inland port of Budapest. Landlocked Hungary, not surprisingly, handles plenty of rail freight. Regter says a train every minute, and that’s entirely believable.

1120: Jeroen Bozuwa from Ecorys economic research takes the floor – to demonstrate the wide network of rail connections from Zeebrugge (he mentions barge and short sea too. Maybe some road routes as well, since the terminal is “traffic-light free” all the way to Paris).

1115 De Vreese says Zeebrugge is wholly owned by Chinese shipper COSCO, and as part of their overall initiate, that will bring goods from all their portfolio of port-side manufacturing right into Zeebrugge. So plenty of deep sea inbound, and that suggests their is a ready market for intermodal forward shipping.

1110: Jeroen Bozuwa from Ecorys, economic research and Pepijn de Vreese from the Port of Zeebrugge take off. Starting the session de Vreese took us for a visual tour of Zeebrugge. Quick facts: man made harbour and 40% of traffic is between the port and the UK. Inland important too with, for example, 50 rail departures weekly to Milan.

1105: Can you blame us for being back a little late? All ready to start our breakout sessions. Delegates choosing between the very practical question of which modality, examining the merits of road, rail, sea and air, and what’s good for different cargoes. Is there one solution that fits all? Meanwhile, we’re on the road – or at least off to the parallel Piet Kingma Hall, to discuss European hubs – and the merits of Zeebrugge, Budapest, Luxembourg and Railgate Finland.

1040: What’s your experience of transit via Russia and sanctions in general? We’re continuing the discussion over morning coffee. Back with you for our break out sessions at 1100.

1035: “Russia will never let us use our own satellite tracking because they don’t trust us.” Groot-Wassink expresses concern about services such as GPS or Galileo being permitted for use in Russia.

1033: “45-foot will be the future, out and back by rail. Returning empty 45-foot by deep sea is not sustainable”, says Reeser, qualifying his statement of a few minutes ago.

1030: “Reseal inspection is required in Russia, but procedures are still to be finalised”, says Negrieieva.

1025: “The amount of freight that goes by sea can never be supplanted by rail.” Controversy from Reeser, who also says that sanctions and regulations are issues, but it comes back to the gauge change that’s the logistics challenge for rail freight via Russia. With rules changing about what’s permitted to transit Russia, there could be a whole new range of goods going via the Russian routes.

1020: Quick change of panel: Katerina Negrieieva (RTSB intermodal container logistics); Hanno Reeser (New Silk Way Logistics); Erik Groot-Wassink (Nunner Logistics – whose facility we visited yesterday at Greenport Venlo). All three have extensive knowledge of dealing with Russia, and handling intermodal trade by rail across the Russian border.

1015: Questioning lines: harmonised container loads? (Vermeij goes over the 20/40/45 foot standard, and the wagon standards in Europe and China are different too).

1010: Questioning lines: dealing with sanctioned entities (Bennink in brief: “don’t”). Be aware of transit too – it’s not just the origin and end point that counts – any layover could exercise sanctions too, and guess who’d be in trouble for busting that?)

1008: The speakers, like those salmons through Russia, is being grilled by the audience in a Q&A session.

1005: Vermeij goes through ‘track and trace’ requirements. It’s not just about customer service, it’s about providing the regulated, required, monitored information 24/7, every 15 minutes of the journey, all across Europe and Asia.

0955: Additional speaker: Bert Roona from LIOF, the inward investment agency for the province of Limburg, joined by Oscar Vermeij, MD of New Silk Way Logistics. They’re both here to expand on the hi-tech solutions to exporting perishable goods long distance. For exporters seeking to fill those 45-foot reefers going east, this is the session to sit up and take note. Oh, and while those trains are enroute, Vermeij’s compnay keeps watch by satellite. That’s about as hi-tech as it gets.

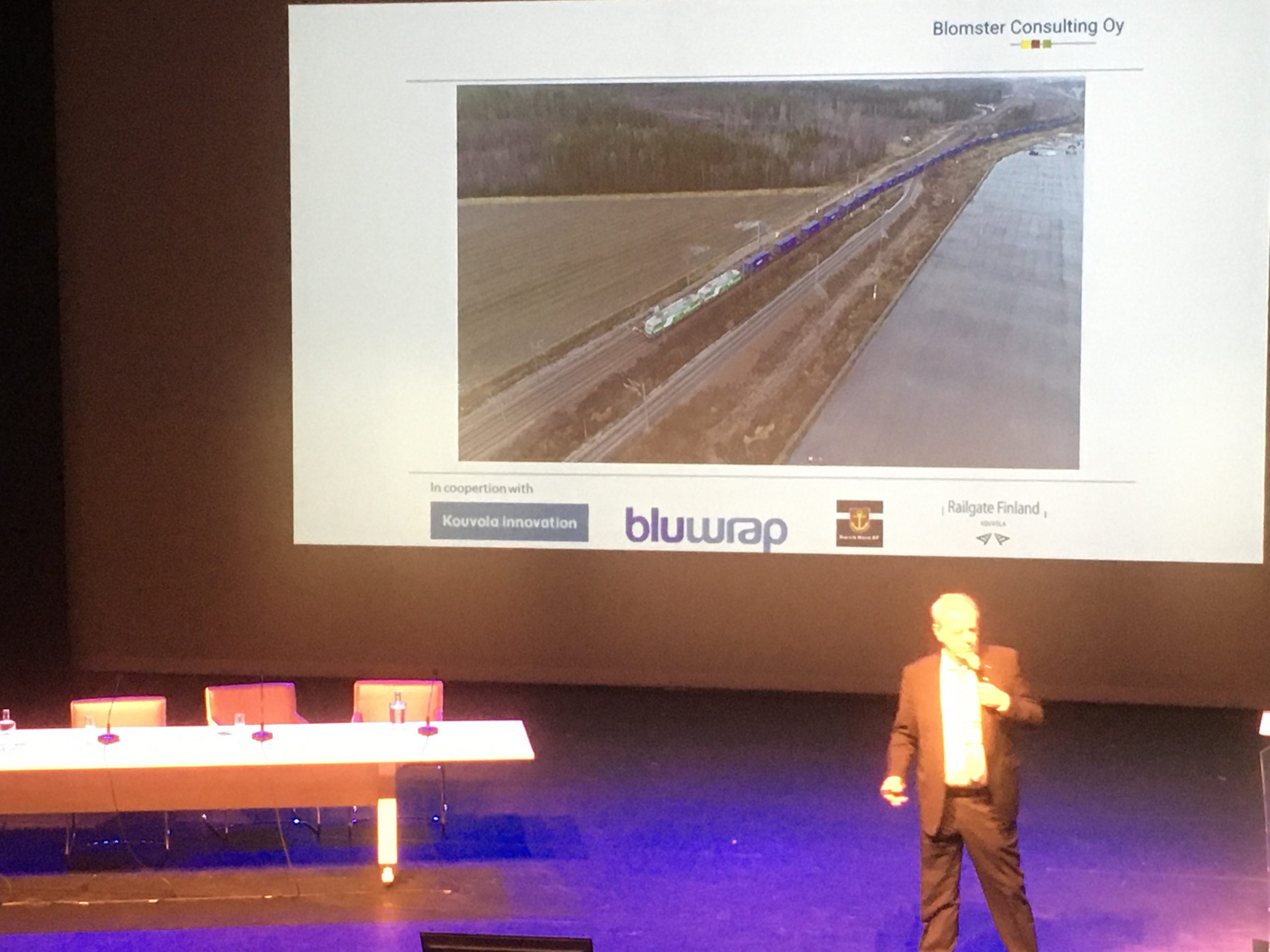

0950: Blomster shows a comparison between different modes and their environmental impact. Widest margin: air freight gets one tonne, one kilometre, at a cost of one kilo of CO2. Take that same load by electric freight train, it’ll travel 9000km. That’s impressive.

0945: New transit technology keeps produce fresh – all the way to China. Check out Bluwrap, says Blomster.

0939: Second surprise fact of the day comes from Micael: Salmon trains run 24/7 from the northern rail terminals in Scandinavia. IN Sweden, salmon trains have top priority. Is this what they call Flying Fish? Seriously, it’s a measure of the importance of the trade – and the important part reliable Railfreight plays in the economy.

0935: First surprise fact of the day comes from Micael: “Finland’s biggest export is … oil. Russian oil.” And we thought he was going to talk about Salmon.

0931: So here’s an interesting case study: Norwegian salmon, through Russia, to China (and via Sweden, Finland and Kazakhstan). By train. Micael Blomster, railway consultant (Swedish born, Helsinki resident – is walking us through the issues involved. (NB: we guess Sweden wasn’t cold enough for Micael).

0930: Bottom line, says Bennink – it’s up to you to keep on top of current sanctions framework – something domestic governments and the EU will be able to help keep you informed (check at home with your government websites or go straight to overseas trade departments). Remember licensing and never delete an email!

0925: Best practice red flags: due diligence – request additional information – ask what your clients intend to do with your goods – keep a file of all questions asked – and the answers given. (lots of notes being taken – delegates reminded they’ll get a full summary after the summit – this is probably worth the attendance in itself).

0920: Sanctioned entities: sovereign states; commercial enterprises; individuals. It’s not always obvious that a sanction is in place. That can be a big issue for you as a trading partner. The first you might know about the problem is when your bank declines to process payment. Top tip: banks are really hot on sanctioned entities (and so is Bennink).

0915: Bennink gives an example of a 500-euro contract that breached sanctions, and cost the company their public tendering licence.

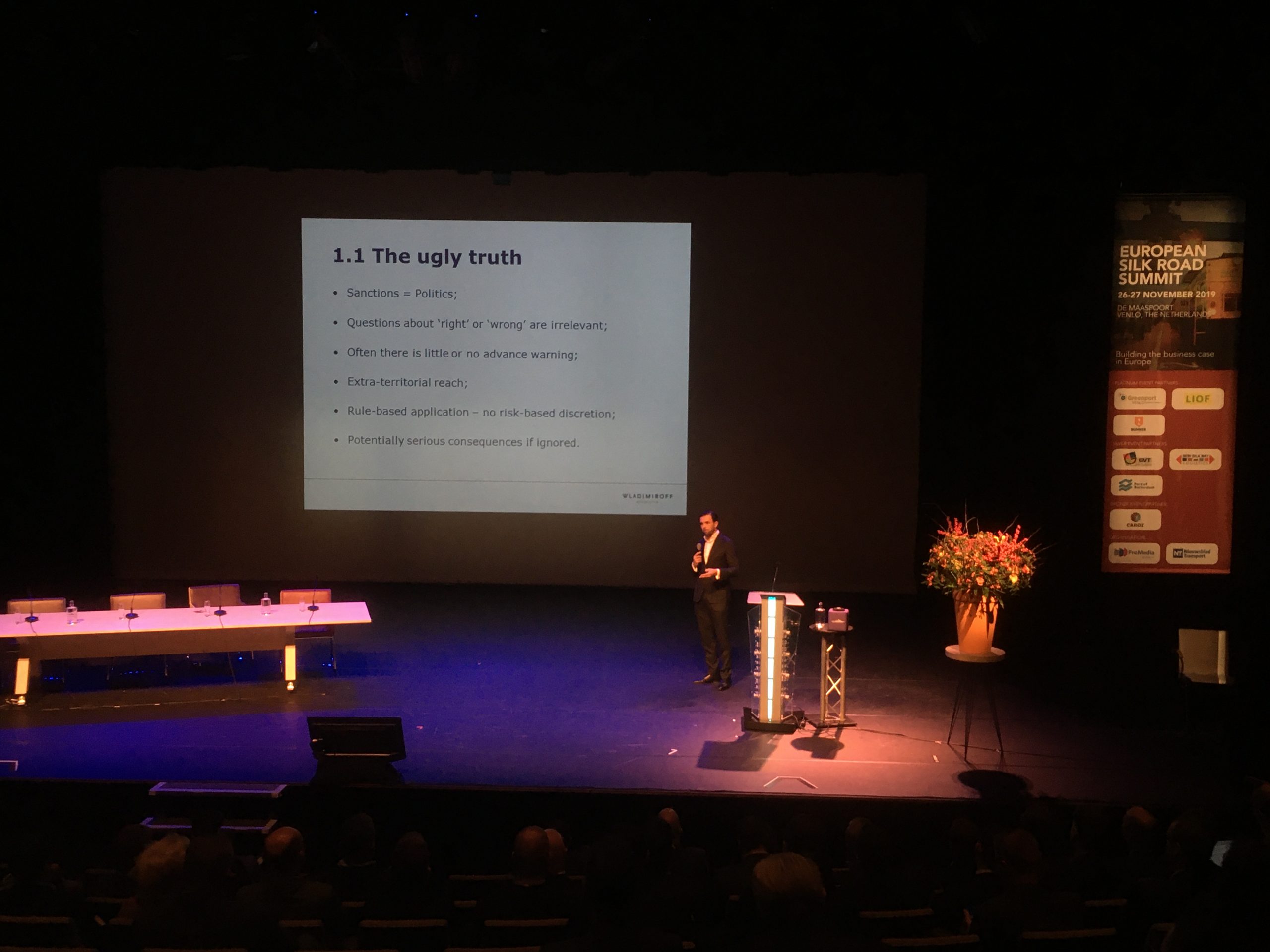

0910: Sebastiaan Bennink is lawyer at Wladmiroff Advocates in The Hague. Economic sanctions explained (it’s a little more complicated than it seems). “Sanctions are political. You have to oblige as a company.” That’s no matter what your own political view. How does that impact on your company’s ethics?

0903: Hot topic for this morning is transit through Russia. We touched on this yesterday and today, we’re navigating our way through a complex sanctions regime.

0900: Forecast for today in Limburg province: cold showers outside, heated debate inside.

0855: We’re just five minutes away from today’s first session. Delegates arriving at Maaspoort Theatre, Venlo here in The Netherlands.